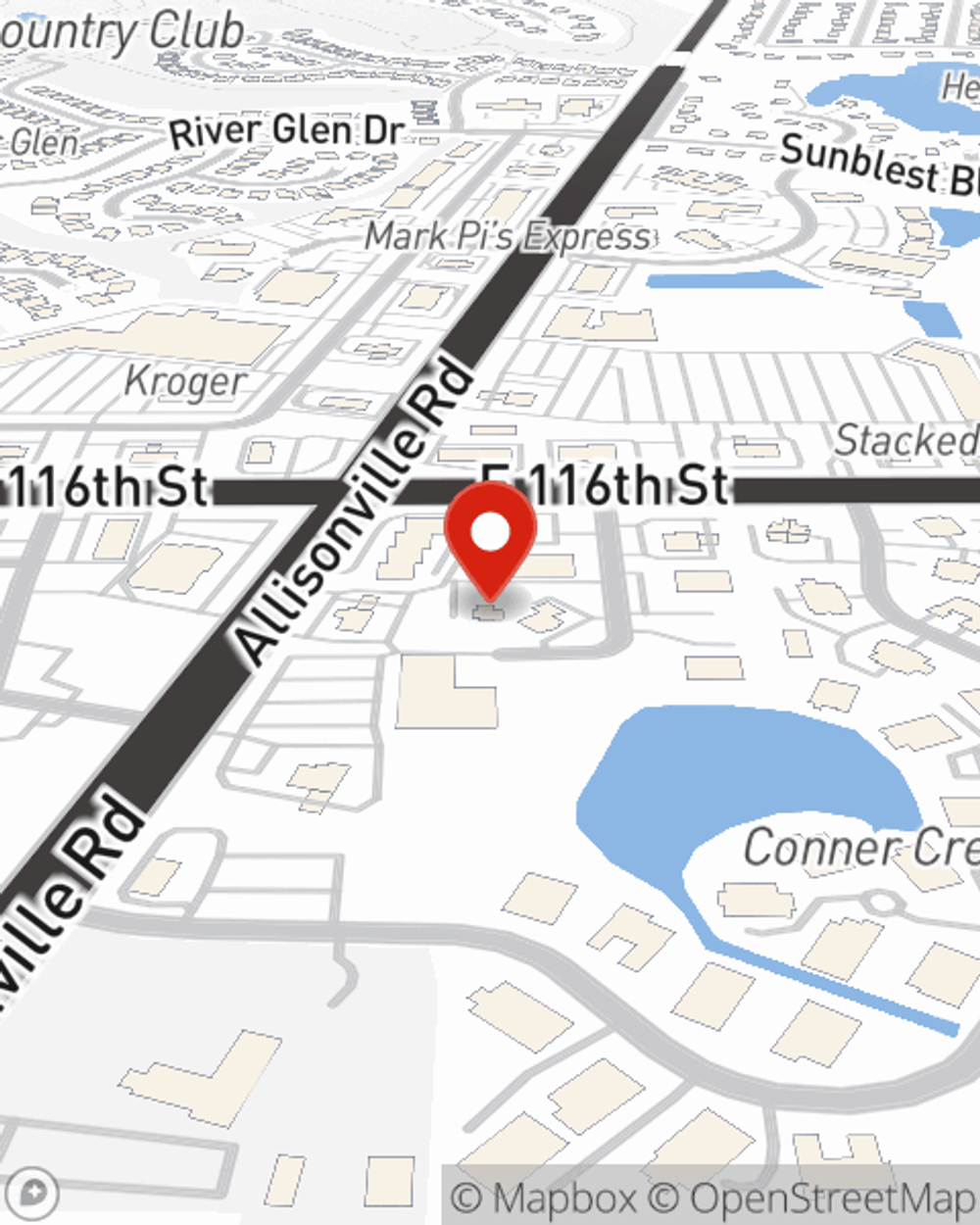

Business Insurance in and around Fishers

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

- Fishers

- Carmel

- Indianapolis

- Westfield

- McCordsville

- Lawrence

- Noblesville

- Anderson

- Lebanon

- Zionsville

- Speedway

- Greenwood

Coverage With State Farm Can Help Your Small Business.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent Amy Henry can relate to the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to investigate.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

Whether you are a florist a hair stylist, or you own a dance school, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Amy Henry can help you discover coverage that's right for you and your business. Your business policy can cover things such as computers and buildings you own.

Visit State Farm agent Amy Henry today to check out how one of the leaders in small business insurance can safeguard your future here in Fishers, IN.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Amy Henry

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.